Archive for the 'Insurance' Category

This post was provided by the Austin Real Estate experts at Realty Austin.

Whether you rent an apartment, home, or condo, renter’s insurance is essential to protecting yourself and your belongings. Though there is uniformity across most insurance policy pricing, you can still find several ways to save money. Here are some easy tips for saving on your renter’s insurance.

The first step is to visit an insurance comparison website. This way, you will know which companies offer the cheapest insurance. There are numerous insurance comparison websites where you can get and compare insurance rates from well-known companies.

Another way to save on your insurance is to buy your renters and auto insurance from the same company. This can save you up to 15% on your yearly premium. Most of these companies offer discounts if you subscribe to their insurance packages.

A third way to save is to pay for insurance a full year in advance. You can usually save about $20 if you pay for your insurance once a year instead of monthly. This also applies to other types of insurance.

If you are a senior citizen, then there’s additional discount benefit in your renter’s insurance. Most companies offer a minimum 10% discount for seniors. Many companies also offer a discount for non-smokers. Smoking is the most common cause of residential fire-related deaths. Quitting smoking will benefit both your insurance premiums and your health.

Your renter’s insurance policy will give you peace of mind in knowing that home is protected. Take the time to estimate the value of everything you own and make sure you are covered for at least that amount. It is essential that you do your homework and research your options before making a decision. Finally, make sure that you review your policy every year. Any significant changes to the value of your home or possessions should be reported to your insurance provider.

Keep in mind that you can save money by simply having insurance. We cannot avoid accidents all the time, but at least we can be covered in the case of an emergency.

Learn more about how to deduct some expenses from your home office.

By Relocation.com

If you have a home office, you may be wondering if you can take the home office deductions from your income tax. If you are self-employed and you use some of your home as your office or primary work area, then you probably can take the deductions. It can be tricky to figure some of this out, but it is worth the time.

Does your space qualify as a home office?

The IRS uses two terms that determine whether or not a space is truly a home office or not: exclusively and regularly. ‘Exclusively’ means that some part of your home is used ONLY for your business. For instance, if you have set up space in your garage for your office but you are still using part of that garage for storage of winter clothes or toys, then it is not being used exclusively for your office. Thus, you can’t say your garage is your home office. The kitchen table doesn’t qualify either. But if you have cleaned out a bedroom and made it your office, then it would qualify.

‘Regularly’ means that you are using your office space on a regular basis. You can’t take the deduction if you only work there a couple of weeks a year, for example. You must have used this space on a consistent basis. If you use that space for, say, six months out of every year, then you can only calculate the deduction for one half of that year.

One exception is if you use part of your home to store inventory. You can take the deduction even if you used that space for some personal use when your inventory ran low.

What percentage of your home are you using?

In order to take the deduction, you have to determine just how much of your home is dedicated to your home office. This can be done in one of two ways. First, if you are using a bedroom in your home, and your home has six rooms, then you are using 1/6th or 16 percent of your home for your office. The other way is based on square footage. If your home is a 2,000 square foot home and your office is 200 square feet of that area, then you are using 10 percent.

What deductions can I take?

If you can qualify for the home office deductions, then you can take many deductions. Some are:

• Direct expenses: money you spend to maintain or repair the office area.

• Indirect expenses: Whatever percentage of your home is your office, you can take that percentage off things like your mortgage or rent, utilities and insurance.

• Interest and property taxes can be deducted by the percentage of your office area

• Depreciation: This can all be tricky, and if you don’t want to face an audit from the IRS you may need to have a tax professional figure it all out for you. You need to keep records of everything.

If you are using storage, be sure to purchase insurance!

By StorageFront.com

After you’ve rented a self storage unit, the first thing to consider is whether or not you need insurance.

At some facilities, it’s not an option; you have to have insurance. But if it’s not an option, you might look around and see the gate system and security camera and think your stuff is safe. But if you’re stuff is worth storing, it’s worth insuring.

Renters have three different options when it comes to insurance.

1. Sometimes homeowner’s or renter’s insurance will offer additional coverage to cover your storage unit (some plans will not cover anything once it’s removed from your home). This is often the cheapest option. If you plan to use this type of insurance, you need to make sure the facility where you are renting allows this as an option. When you go to rent, you need to make sure to take proof of insurance to the storage facility.

2. Some storage facilities offer their own insurance. The policies cover anywhere from $2,500 to $5,000. They may not require a deductible, but the rates maybe higher and coverage lower. It’s also important to ask what items the insurance will cover and what type of damage will be covered as well.

3. For more valuable storage, the best option might be to go with independent self storage insurance. These insurance companies might have a sort of partnership with the storage facility but operate independently. This type of insurance will insure higher-valued items and protect against damage that other insurance may not.

Insurance typically runs:

• $8 for $2,000 coverage

• $12 for $3,000 coverage

• $20 for $5,000 coverage

Some provide 50 percent burglary coverage for a cheaper rate. Jon Vogel is a Senior Account Executive at Bader Company, an independent self storage insurance provider. Vogel said he advises against getting the 50 percent burglary coverage.

“The only problem with that is our number one leading loss function is burglary,” Vogel said.

In case of burglary, Vogel suggests taking several measures to help guarantee that your claim will be processed if burglary occurs. Vogel said to use a disc or cylinder lock, which prevent many attempted burglaries. Bader Company waives the deductible if a renter uses a disk or cylinder lock.

When you put your storage inside your unit, Vogel said to take pictures of everything. If your valuables are stolen, take pictures of any damaged items and the damaged door. Vogel said to also keep everything and don’t throw anything away, even the lock. The insurance company will ask for some kind of proof of a break in, and the damaged lock should suffice.

As with any insurance, it’s important to understand the insurance that you’re getting and what is covered. Most facility managers are not certified to give advice or answer questions. Some public storage facilities in California have recently come under fire after offering advice and reportedly not processing claims.

“At no time is the facility manager an insurance agent,” Vogel said. “If you have questions specific to the insurance, most of them if they have gone through training with us will direct you to call us. No matter what insurance agent or company providing, there should be an 800 number. You should call insurance company.”

As with any insurance, the most important thing to remember is to do your research on the company, ask questions and get the rate that’s right for you. And don’t forget your camera to take pictures of the facility!

Looking for storage? Check out StorageFront.com for a local storage facility near you.

October 6th, 2010 by

Admin

Categories:

Celebrity Real Estate,

condos,

design and decorate,

Do It Yourself,

foreclosures,

Home Improvement,

homes for sale,

Insurance,

Mortgages,

Moving,

Moving Industry,

Packing,

Real Estate,

Relocation,

rentals Comments:

No Comments » By Serena Norr

We never know what to expect when we research the celebrity housing market for the Beat. This week we were excited to learn that Steve Jobs was finally given the go-head to start the demolition of the historic property he owns called the Jackling House. The demolition, which took six years to approve, will involve the construction of a smaller and more contemporary space — simplifying the home and tearing down its 30 rooms that will reportedly cost Jobs $8.45 million to complete. This week, we also discovered that Larry the Cable Guy’s home was placed on the market. Listed for $1.55 million and developed by the “Git-r-done” comedian, the Florida log-style home includes a “man cave” with a pool table, TV, mini-bar and bar signs as well as a pool and a spa. Acting couple, Naomi Watts and Liev Schreiber are also on the Beat this week. They placed their 4,410-square-foot Los Angeles home on the market that includes an on-site gym, a two-story guest house and six-bedrooms. We look forward to what next week brings…and the (unexpected) real estate news that follows.

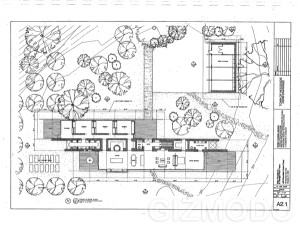

Floor plan of Steve Jobs' new home -Expected construction costs: $8.45 million. (Photo Credit: Gizmodo)

• Steve Jobs’ Construction Plans Revealed

Steve Jobs, the multi-billionaire and CEO of Apple finally received the go-ahead to renovate the historic Jackling House. The 17,000-square foot, 30-room Spanish Colonial home, built for copper baron Daniel Jackling, is owned by Jobs but he has been unable to complete or even start his plans for a full-on demolition and remodel. Architectural preservationists stated that the home was an historic piece of real estate and shouldn’t be demolished. Finally in July of 2010, the preservationists’ dropped their case but some elements of the house such as an organ, flag pole and decorative tiles are being removed and preserved. The newer and more contemporary home plans was reveled on Gizmodo – showing the elaborate floor plan created by Bohlin Cywinski Jackson – the design firm responsible for several Apple stores. The new floor plan indicates a smaller home – measuring at 4,190-square-feet – that will include five bedrooms and 3.5 bathrooms. The new design also indicates that there are plans to build a three-car garage, a pool with a pool house and a third building for an office. Additionally, among the six acres of land there are plans to add various plants and flowers, stone walkways and a private vegetable garden – a diminutively simpler home than the former grandiose estate. It is estimated that the home will be completed in 22 months.

Naomi Watts and Liev Schreiber's home - listed for $5,995,000. (Photo Credit: The Real Estalker)

• Naomi Watts and Liev Schreiber List Brentwood Home

Actor couple Naomi Watts and Liev Schreiber recently placed their Los Angeles home on the market for $5,995,000. The 4,410-square-foot, two-story home includes six bedrooms and 4.5 bathrooms; a two-story guest room; an on-site gym; a two-car garage and a gated and secured entry way. The European-inspired home also includes several fireplaces, an eat-in kitchen, formal dining room, a swimming pool and circular spa. The couple also owns a 2,900-square- foot condo in New York.

You, too, can have your own personal "man cave" if you buy Larry the Cable Guy's home - listed at $1.55 million. (Photo Credit: Housing Watch)

• Larry the Cable Guy Places Florida Home on the Market

Comedian Dan Whitney aka Larry the Cable Guy known for the catchphrase “Git-r-done” recently placed his Sanford, Florida home on the market for $1.55 million. The five-bedroom home, situated on 18.79 acres, includes a lot of interesting details that Whitney himself renovated. There is a “man cave” that includes a poker and pool table, mini-bar, TV and bar signs as well as an outdoor movie theater, a pool with a waterfall, an outdoor spa, detached gym and two children’s rooms with personal murals. Whitney sited outgrowing the home as the reason for the sale.

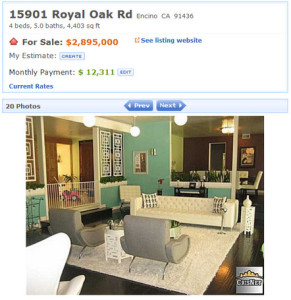

Scott Baio's home - sold for$2.5 million. (Photo Credit: Zillow.com)

• Scott Baio Sells Encino, California Home

Actor Scott Baio recently sold his “Spectacular Celebrity Owned Estate!” to an undisclosed buyer for $2.5 million. Built in 1964, the new buyer can look forward to enjoying 4,400-square-feet of living space, three fireplaces, four bedrooms and 4.5 bathrooms. The Encino, California home also includes a swimming pool with a hot tub, a tennis court, a koi pond, a formal living and dining room and a sprawling back yard with luscious greenery and gardens.

August 11th, 2010 by

Admin

Categories:

Celebrity Real Estate,

design and decorate,

Do It Yourself,

exterior projects,

foreclosures,

Home Improvement,

homes for sale,

Insurance,

interior projects,

Mortgages,

Moving,

Plan Your Relocation,

Real Estate,

Relocation,

Relocation Data,

rentals Comments:

1 Comment »

Joey Fatone's home for sale - To be sold at auction for $6.5 million

By Serena Norr

We had quite the mixed bag of homes for sales and home purchases this week. “Extra” host Mario Lopez recently purchased a 4,430 square-foot home in Glendale, California for the obvious reasons: outdoor pool, courtyard with a fountain and state-of-the art and modern amenities as well as for the not-so-obvious reasons: it will be the location of his new reality show where he and his baby mama will be filmed as they experience the trails of becoming new parents. While some may tune-in to catch Lopez juggle his abdominal workouts while changing diapers, we are more interested in seeing how he will upgrade and personalize his Spanish-style home with home improvement projects and decor. Disney star-turned-actress, Hilary Duff also made this week’s Beat for purchasing an elegant Toluca Lake estate with her fiancé Mike Comrie for $3.85 million. We also reported on an interesting auction of the home of Joey Fatone. Fatone, who was in the band ‘NSync, is asking $6.5 million for the home that features a swimming pool and an outdoor sushi bar. These properties never cease to amuse and amaze us! Until next week…

• Former ‘NSyncer, Joey Fatone Selling Orlando Home for $6.5 Million

Joey Fatone, of the popular 90s boy-band ‘NSync, will auction his home for $6.5 million citing wanting to be closer to his family as the reason for the sale. The gated estate, located in Orlando, is situated on 4.4 acres of lakefront property that includes 10 bathrooms, a 10-car garage and six bedrooms, including a 3,800 square-foot master suite with a butler’s pantry. The home also has 12,400-square-feet of living space that includes a movie theatre with stadium seating and an outdoor grotto area with a sushi bar, swimming pool and spa. The minimum bid for the auction is $3.7 million, which will take place on September 11, 2010.

• Mel Brooks Sells Ocean-Front Home for $5.3 Million

Comedian and director Mel Brooks recently sold his Watermill, New York home for $5.3 million. The 1,968-square-foot property was originally purchased for $2,995,000 by Brooks and his late wife, Anne Bancroft, which has been rented out for several summers. The home, situated by the ocean on. 74 acres, includes three bedrooms, two bathrooms, a fireplace and is right down the street from last week’s celebrity beat seller, Christie Brinkley.

• Leeza Gibbons Buys New Home for $6,600,000

Entertainment reporter Leeza Gibbons recently purchased a home in Beverly Hills, California for $6,600,000. The Mediterranean-style home includes five bedrooms, 5.5 bathrooms and backyard complete with a heated swimming pool, spa and lush greenery. The 6,579-square-foot home also includes walnut wood flooring, a family room, a fitness room, a billiard room, an office, a three-car garage, a home theatre, four fireplaces and a state-of-the-art security system.

• Mario Lopez Gets a New Home for $1,940,000

Mario Lopez of “Saved by the Bell” fame recently purchased a new home in Glendale, California. Sold to Lopez for a modest price tag of $1,940,000 (at least in celebrity real estate terms), the home will soon be seen by the rest of America when VH1 starts filming a new reality series about the trials and tribulations of Lopez’s life with a new baby. If you can’t wait to see the show, we can tell you the Spanish-style home includes four bedrooms, six bathrooms, three-car garage and a gorgeous courtyard with a fountain. The home, built in 1929, is fully renovated that also includes 4,430 square-feet of living space, a eat-in kitchen with modern appliances, an office, a formal dining area with hardwood flooring, arched doorways, fireplace and a swimming pool.

Exterior shot of Hilary Duff's new home - Sold for $3.85 million

• Teen Queen Hilary Duff Buys Home for $3.85 Million

Hilary Duff, former Disney star- and sometimes-designer/singer/actress recently purchased a colonial-style home for $3.85 million with her her fiancé Mike Comrie. Located in Toluca Lake, the elegant 5,260-square-foot two-story house includes five bedrooms, 6.5 bathrooms, an outdoor fireplace and a swimming pool and a modern kitchen with stainless steel appliances. Other amenities include a wet bar, French doors located throughout the home, a curved staircase, high ceilings and hardwood flooring. Duff and her fiancé Mike Comrie can also look forward to getting to know other Toluca Lake residents like Jenny Garth, Gwen Stefani and their next door neighbor, Britney Spears.

BON SECOUR NATIONAL WILDLIFE REFUGE , Ala. - Relocation procedures for sea turtle that are too close to the tideline. (Photo Credit: U.S. Fish and Wildlife Service photo by Bonnie Strawser)

By Serena Norr and Joann Pan

As we discussed in the first part of this series “The Devastating Impact of the BP Oil Spill on Real Estate,” the oil spill off of the Gulf Coast has not only affected our waters, marshes, animals and our health, but the “worst spill in history” has also greatly impacted the real estate industry. Although we are happy to hear that engineers have been able to stop oil gushing from the well [LA Times Blog], there is the looming question pertaining to the state of real estate in Alabama and Mississippi. Early numbers are estimating that the oil spill will “drive down the Gulf’s property values by 10 percent for at least three years,” according to CoStar Group Inc [Bloomberg]. The International Property Estimate stated that “losses may total $4.3 billion along the 600-mile (966- kilometer) stretch from the Louisiana bayous to Clearwater, Florida.”

Since April 20th, new property developments in Alabama and Mississippi have been put “on hold” and commercial properties such as hotels that are suffering from a decline in tourism and the inability to provide certain supplies such as with restaurants that can no longer offer fresh and local shrimp, oysters, etc. Some of these real estate issues are not immediate, but will impact these areas long after the spill has been cleaned. Will people want to relocate to an area that was once covered in oil — whether directly or nearby? Will the water ever be clean enough for fishing? Will tourism pick up? As the pieces are starting to be picked up and clean-up efforts are prevalent in the Gulf, we will be keeping a watch eye, hopeful that we will be able to report on positive news from the Gulf.

GALVESTON, Tx - Cleaning up tar balls off on Galveston beaches. (Photo Credit: U.S. Coast Guard photo by Petty Officer 2nd Class Prentice Danner)

Alabama’s Businesses Suffer Including Restaurants, Condo Owners, Shops Owners and Fishing Industries

For three months, after the media has continually projected the dismal prospect of coastal communities affected by the BP Oil Spill to the rest of the world, the states lining the Gulf of Mexico are seeing and feeling the onset of low numbers of tourists and homebuyers. When President Obama went to see the effects of the BP oil spill on the state in mid-June, Governor Bob Riley and the communities of Alabama were relieved to have president see the effects for himself. In a speech, the president addressed the jabs that the tourism and fishing industries have suffered. The lives of Alabama’s shop owners, restaurateurs, commercial and sport fishermen and those in real estate have not seen normal business for about three months [Montgomery Advertiser]. As oil continues to wash to shore, it’s not the effects on the beaches that worries community members, but the state’s precious marshes, estuaries and wetlands that will be lost. Tourism is also down, which is evident by the pictures of empty beaches that would normally be flooded with people. There are men bringing booms down to the waters—approximately 10,000 feet of booms a day to keep the oil at bay.

As soon as the oil started leaking—rather gushing relentlessly into the Gulf of Mexico—officials and professionals have been implemented quick clean-up of the space. As personnel continue to tread the waters of the Gulf, people are coming forward with disaster-related illnesses. In Louisiana, their Department of Health is aware of 71 cases and in Alabama, there are 15 reported illnesses—a mix of respiratory problems and skin irritations [CNN Health]. As soon as news like this hits to mainstream, areas where tourism and properties are hot start to see businesses fade.

The NY Times painted a dreary picture for us on July 5 by running a feature about an Alabaman seaside Inn that has seen the scary effects of the oil spill that include a lack of bumper-to-bumper traffic along Perdido Beach, minimal diners at coastal restaurants, missing swimmers in the water and a diminished population of seagulls riding up the coast. And in the place of those summer beach expectations are tar balls and lines of oil that have layered themselves in the daily repetitions of low tide and high tide that brings new sand and oil on shore. The building’s owner is Jerry Gilbreath, 61, who bought the structure in 1980 and turned it into a successful bed-and-breakfast. Now, Gilbreath, like other resort, hotel and property owners in Alabama are struggling to meet ends meet. To give you an idea the inn made $21,000 last June, but only made $6,000 this June, a month after the drum of oil starting leaking [the NY Times].

NEW ORLEANS - Debris and oil in the Gulf of Mexico from the Deepwater Horizon drilling.

Mississippi’s Job Loss, Real Estate Outlook and Tourism Industry

Since the oil spill, 4,500 unemployed workers in Alabama, Louisiana, Florida and Mississippi have been hired to clean the beaches– raking and shoveling debris, taking out trash and using power loaders to wash away oil-covered rocks [CNN Money]. Although finding work is always a positive sign (especially since Mississippi has an 11.5 percent unemployment rate), the conditions in which these workers were hired is not something residents of these Gulf States were expecting.

The immediate impact of the spill is not the only matter at hand, but one that Mississippi will be dealing with years after the spill; especially when pertaining to real estate. Recently, several real estate agents and brokers have requested $20 billion dollars as compensation for the loss of sales due to the oil spill. Kenneth Feinberg, a Washington attorney who is working on organizing money for the victims, stated “The Realtors and real estate brokers are a major political force. I’m hearing from them constantly. I’m not sure whether they have a valid legal claim.” As of now, these claims fall into the category of “tough eligibility decisions,” whose issue will be further explored through an independent committee held next month [SunHearald.com].

There is also the issue of the loss of jobs and tourism in Mississippi. A University of Mississippi study found that the oil spill could cost Jackson, Harrison and Hancock counties nearly $120 million in the tourism and service sectors; while the Mississippi Development Authority estimated that tourism was down statewide and about “seven percent in fiscal 2010 to $5.2 billion” [Insurance Journal]. Hit the hardest right now are non-casino hotels, which are down by $50 million and services related to tourism such as restaurants, beverages and food and area beaches (even though no oil has been washed onto Mississippi’s beaches). According to David Bulter, a professor who conducted the survey, these figures are related to the “negative images portrayed by the national news.” There has also been a decline in charter boats and recreational and commercial fishing.

Now that the leaking has been stopped by a temporary cap—until further measures can be made, that is—we wait and hope for positive news in the upcoming months.

Sources and Additional Reading:

All photos are from Deepwater Horizon’s flickr page- http://www.flickr.com/photos/deepwaterhorizonresponse/

THEODORE, Ala. – An oiled gannet is cleaned at the Theodore Oiled Wildlife Rehabilitation Center. Photo by Petty Officer 3rd Class Colin White.

By Serena Norr and Joann Pan

The numbers are startling: 60,000 plus barrels of oil a day [The NY Times], thousands of fishermen without work [CNN] and an expected 30 percent decline in home values [Housing Watch]. By now, we have all heard about the devastating events that took place on April 20, 2010 – an oil rig exploded off of the Gulf of Mexico spreading crude oil and toxins [including the poisonous Corexit [The NY Times] along the shoreline. Deemed, the “worst oil spill in U.S. history” [National Geographic], the consequences of this unfortunate event have caused an environmental upheaval – affecting our water, marshes, animals and some believe, our health.

Being in the moving industry, we are also greatly concerned with how the spill is affecting the real estate industry – specifically commercial and residential properties, new developments and vacation homes. Some of the affects of the oil spill are already apparent: restaurant owners fear not having fresh fish will put them out of business [McClathchy], hotels are fighting to stay open [The NY Times] and once thriving tourist areas have become ghost towns [CBS News]. A survey conducted by Greater New Orleans, Inc, entitled “Potential Economic Impact of BP Oil Spill” indicated that “50 percent of businesses said they are expected to be hurt by the spill – citing direct interruption of their business due to the spill or false perceptions of the oil spill; while 53 percent of businesses stated they will need outside assistance to regain their losses.” Part of this assistance will come from an independent compensation fund established by the U.S. government — who will toll out $20 billion to compensate those who were greatly affected [CNN]. Although, this is a sizeable amount, there has been no indication as to whether this will cover personal property loss.

Not only an issue for the present, we wonder how the spill will affect the real estate industry in a few years. Will people be excited to build and vacation in the Gulf? Will commercial properties thrive again? Will BP award sufficient money to cover these devastating losses – ranging from fishing, tourism, ecological preservation to real estate? As we follow the headlines, we can only think of the worst in order to prepare best as we learn more about this awful spill in our two-part BP real estate series.

PENSACOLA, Fla. - A Coast Guard inspects oil that has washed onto the beach. Photo by Tech. Sgt. Emily F. Alley.

How the BP Oil Spill is Affecting the Coastal State of Florida

We are quickly approaching the two-month mark of the Transocean Ltd. Deepwater Horizon Oil Spill where (at press time), we learned that BP engineers have been able to stop oil gushing from the well [LA Times Blog]. Although, a welcome relief from the disparaging news we have heard since April; there is still a lot of work to be done. More than 93.5 million to 184.3 million gallons of oil have escaped the bruised well into the Gulf of Mexico [LA Times Blog] making its way down to the coastlines of our southern-most states.

So far, the oil has made its way to the coastlines of our southern-most states — estimated to be 130 miles long and 70 miles wide. Florida’s Governor Charlie Crist has already declared a state of emergency as the oil reaches the Panhandle. The oil slick covers 69 miles of Florida, 328 miles in Louisiana, 108 in Mississippi and 67 in Alabama, according to The Governor of Florida’s Website. Tar balls have been recovered on Pensacola Beach and the Perdido Key.

PENSACOLA, Fla. - Workers cleaning oil. Photo by Tech. Sgt. Emily F. Alley.

The BP Oil Spill will definitely bring long-term effects to Florida that at this time unforeseeable. The Palm Beach Post of Florida estimates that Florida will have a loss of 195,000 jobs and nearly $11 billion in revenue losses. These numbers were estimated by a University of Central Florida economist who believes the southern state will suffer from lack of jobs — especially Pensacola fishermen — and from decreased tourism to the nearby Orlando theme parks and the Palm Beach luxury hotels. [The Palm Beach Post] However, the local media outlet does expect reimbursements from BP itself for the canceled reservations over this current summer season, the loss of fishing, clean-up fees, and for other local effects from the nearby explosion of the rig.

The St. Joe Company (NYSE: JOE) is one of the biggest landowners in Florida and has also had one of the toughest times in the midst of the oil spill. With approximately 580,000 acres of land, mostly in Northwest Florida, St. Joe has made a great business based on tourism and owning eight luxury resorts near the Panhandle. According to

realestatechannel.com, St. Joe has refunded money for approximately 151 coastal homes and for a 60-room inn because of the oil. Many local companies are giving out refunds because of people afraid of the effects of the oil spill. St. Joe and other organizations are tackling the BP Oil Spill by asking for reimbursements of business lost and interrupted.

Another case of loss in the situation in Florida is that of Naples beachfront homeowner Cynthia Joannou, who is suing BP for causing environment issues for homeowners who own property along the coast and who will deal with long-term issues, according to m.naplesnews.com. Joannou claims that homebuyers are shying away from moving to Florida strictly because of the cumbersome oil spill. These losses will amount up to $4.3 billion along the entire 600-mile coast line from Louisiana’s bayous to Clearwater, Florida in property estimates, according to Bloomberg. A local realtor in the same article said that this environmental travesty is “the knockout punch the Great Recession didn’t deliver.”

Loss of Jobs, Homes and What is to Come in Louisiana

More than 65 miles of Louisiana’s shoreline—including its beaches and wetlands—are now covered in oil, according to Louisiana’s Governor Bobby Jindal, as stated on The Boston Globe. What once was a vibrant fishing community, thriving vacation spot and an area beginning whose real estate market was revitalizing is once again back in the national spotlight – only five years since Hurricane Katrina.

NEW ORLEANS – Rescue of a loggerhead sea turtle. Photo by Seaman Grace Baldwin.

As a result of the BP Oil Spill, it is expected that Louisiana’s real estate market will drop from five percent to 15 percent in the next 12 months. Home builders – who are still rebuilding – from the devastating effects of Hurricane Katrina have delayed or stalled numerous projects along the Gulf. According to real estate agent Carolyn Angelette, 100 of her clients have canceled their vacation rentals in Grand Isle, Louisiana, as stated on the blog, The Coming Depression. Other reports in Bay County have indicated that housing developments have simply stopped. Tom Ledman, president of the Home Builder’s Association of Panama City-Bay County stated there are no signs as to when construction will start up again [News Herald].

Louisiana’s job market is also estimated to be affected by the oil spill. Based on the “Economic Impact of the Moratorium and Oil Spill” study, it is estimated that 22,000 people will loss their jobs as a result of the oil spill with an overall loss of $8 to $15 million dollars per month – indicated by the surveys worst case scenario model. Jobs such as the fishing industry are also believed to take the biggest hit – bringing $500 million dollars in revenue to Louisiana, followed by processors and then the tourism industry, according to the survey conducted by the Greater New Orleans, Inc. The survey states that encouraging eco tourism, a positive vibe and not selling your home are critical during this disparaging time.

JEFFERSON PARISH, La. Bay Jimmy is one of the more impacted zones remaining in the area. Photo by Petty Officer 3rd Class Zac Crawford.

The issue at hand within the property market has plummeted across the southern coast of the United States. Hotels and home owners are having trouble keeping up with mortgage payments. Many media outlets have reported a total exposure of $136.4 billion to commercial real-estate owners and developers in affected states Alabama, Florida, Louisiana and Mississippi.

Follow us in a few weeks, as we weigh-in on how the oil spill has affected the real estate market in Alabama and Mississippi.

Sources and Additional Reading:

All photos are from Deepwater Horizon’s flickr page- http://www.flickr.com/photos/deepwaterhorizonresponse/

Exterior Shot of Former Church- Listed at $7.49 Million (Photo Credit: Zillow.com)

Living Room of Redesigned Church in San Francisco (Photo Credit: Zillow.com)

By Serena Norr

Homes for sale in the million dollar price range seem to be the theme of this week’s Celebrity Beat. From spacious mansions in Tennessee to Manhattan co-ops with secret passageways to a converted home that once was a church; we’ve got you covered with the latest real estate buzz. Check out the Beat and let us know what you think of these unique (and pricey) listings.

• Sheryl Crow’s Nashville Home on the Market for $7.5 Million

Purchased in 2008, singer Sheryl Crow recently listed her 154-acre Tennessee home for sale. Horse lovers will surely love this equestrian abode, equipped with a 14-stall barn with enough acres to practice riding, as well as sufficient space to let horses run free. The gated mansion/farm hybrid is marketed as a “solar home” according to Zillow.com that is” designed to reduce electric costs by 42 percent” thanks to its modern and energy efficient appliances. The home also features private quarters, fireplaces, a guest house, an outdoor pool, indoor riding arena, a state-of-the-art media room and a music studio.

• Penelope Cruz’s Home on The Market for $3, 695, 000

Actress Penelope Cruz recently put her Bali-style home on the market for $3,695, 000. Constructed in 1956, the Hollywood home features views of the Sunset Strip that Ms. Cruz has owned since 2005. The 3,334-square-foot one-story home features three-bedrooms and 3 1/2 bathrooms, bamboo flooring and French doors. There is also a tiled courtyard with a fountain, an outdoor pool with a heated patio, an office and a modern kitchen with a breakfast nook. Cruz is moving on since she already has other properties in Los Angeles and a home in Spain.

• Golden Girl-Rue Mc Clanahan’s Co-op on the Market for $2.5 Million

The New York City co-op of recently deceased Golden Girl is on the market for $2.5 million. Located in midtown Manhattan, the apartment is full of charm and unique attributes such as a “spice rack that turns into a secret passageway” and amazing views (and access to) a private garden, complete with professionally landscaped flowers and plants—functioning as a private oasis, according to CurbedNY.com. The apartment also features three bedrooms with a master suite, two baths, high ceilings, great lighting, a library and a modern kitchen.

• Alan Jackson’s Home Sold for $28 Million

Country crooner, Alan Jackson recently sold his Tennessee mansion for $28 million to multi-millionaire, Willis Johnson. Originally listed at $38 million, the mansion known as “Sweetbriar” is situated on 135 acres of land that features six bedrooms and seven baths. There are also five fireplaces, a 20-car garage, a private lake with its own boat house, three ponds, a gym and a separate guest log cabin with two bedrooms.

• Converted Church on the Market for $7.49 Million

Not a celebrity property but one that will surely cause the same jaw-dropping effect, especially since this Gothic-style building once functioned as a church. Built in 1910, the exterior appears to look like a church; however the interior space is a gorgeous updated single-family home with high ceilings, seven chandeliers, three bedrooms and two baths. This San Francisco home also features arched and long stained glass windows (some indication that it once was a church), along with modern amenities such as spacious kitchen, a den, a large dining room, two fireplaces, a wine cellar and a media room with a recording studio. The church home also features a six car garage and mahogany doors to welcome guests to this massive complex.

Biking in the City

Let’s Get Physical: Where are the Healthiest Cities to Live?

By Serena Norr

A wise person once said: “Your health is your wealth.” Although this can’t more true, living in major metropolitan area such as the great (and stressful) New York City makes it rather challenging to stay on top of the healthy game – both physically and mentally.

Regardless of what stressors plague their way into our lives, we try our best by eating well, exercising and staying mentally stimulated (oh, do we try!). But despite what we do, some geographic locations are prone to induce stress and affect our health more than others.

While some cities are major detriments to our health, there are others that actually encourage healthy living; ranging from those with numerous outdoor parks and facilities to those that focus on eating healthy from local resources. Centrum and Sperling’s Best Place recently uncovered the healthiest cities to live; ranking how they stack up in the categories of mental, lifestyle, activity, health and diet and how they contribute to ones overall well-being. From the looks of this survey, cities in California are leading the pack, with Indiana not doing so well—which oddly enough is one of the most affordable places on our buy vs. rent report. Check out what healthy spot would be ideal for your next relocation.

Sperling’s Best Places Healthiest Cities

1. San Jose, California — As the third largest in California, San Jose is renowned for its spacious gardens and parks (Almaden Quicksilver County Park, Alum Rock Park and Kelly Park, to name a few), outdoor festivals and cultural attractions such as the San Jose Museum of Art and the Tech Museum of Innovation. Being the number one healthiest and cleanest cities, San Jose residents rank highest for health, diet and lifestyle. And its no wonder, since residents have access to numerous outdoor trails for walking, running, camping and mountain climbing, as well as other recreational sports that encourage exercising outside. With rents averaging $950-1,200, according to apartments.com and two-bedroom homes at $450,000, San Jose, California is also an affordable moving destination.

2. Washington, D.C. — As the nation’s capitol there is never short of something to do in Washington, D.C. According the cities website-Washington.org, D.C. is the number one city for walking, which is a great way to discover the areas historic monuments and museums. Residents also rank the highest for mental health and diet, along with affordable living that features modern and historic neighborhoods. Homes average $330,000 and increasing in sales of 2.36 percent in March, 2010, according to ziprealty.com.

3. San Francisco, CA— On top of being number three on Sperling’s list, San Francisco, California residents were recently surveyed by the Kaiser Family Foundation for the state of their health and wellbeing. The results? 71 percent of residents reported being in excellent or good health. And it’s no wonder why with a city that encourages walking, biking and running up and down its uphill and windy streets. Activities don’t fall short here either with golf, trips to Fisherman’s Wharf, the Yerba Buena Gardens or simply taking in the views of the Golden Gate Bridge. Rents range from $1,000-1,200 for a two-bedroom apartment, according to apartments.com and homes average $799,000, according to zip realty.

4. Seattle-Bellevue-Everett, WA— It’s not all rain and coffee (although this is part of the Seattle, Washington experience) in the Seattle-Bellevue-Everett areas of Washington. This healthy city is renowned for their outdoor activities— biking, fishing, running and exploring— that is also considered one of the cleanest cities to reside. Residents can also enjoy the Space Needle, visits to the Pike Place for fresh fish, local fruits and vegetables, walks to the waterfront and exploring the areas many zoos, sporting facilities and wildlife trails at the Northwest Trek.

5. Salt Lake City-Ogden, UT — This outdoor lover’s paradise is home to the historic temple square, national parks (The Bonneville Salt Flats, Kennecott Copper Mine and Miller Motorsports Park) and attractions such as The Utah Museum, the Historic Temple Square of Natural History and Great Salt Lake. A healthy culture, Salt Lake City is also all about outdoor recreation where residents can enjoy skiing, golfing, biking, hiking, camping and extreme sports such as scuba diving, rafting, paragliding and skydiving to keep you busy and very active. The average two-bedroom rental in Salt Lake City, Utah is $804, according to mynewplace.com.

6. Oakland, California — Another California City-are we starting to see a trend? Oakland, California ranks very high on the list for its healthy lifestyle choices and activities available to its residents. Visits to Peralta Hacienda Historical Park, Preservation Park and local attractions (Chinatown, Oakland Museum of California and the Chabot Space and Science Center) are a part of life in Oakland; along with access to healthy dining options, farmer’s markets and walking that keep residents fit. Apartments average $895 for a two-bedroom place, according to mynewplace.com and homes averaging $895,000, according to zillow.com.

7. Sacramento, California — The state capital, Sacramento, California ranked very well in the lifestyle, activity, health and diet categories, which is apparent by the areas attractions that includes historic buildings, museums, and recreational parks (Old Sacramento national and California state historic park). Residents can also take advantage of the areas natural surrounding area by biking, hiking, camping, golfing and partaking in numerous recreational sports throughout the year.

8. Orange County, California — Much as been chronicled about life in “The O.C” by reality shows, but little is discussed of the high quality of diet, lifestyle, activity and metal health in Orange County, California. With 42 miles of coastline, numerous beaches and recreational parks that include historic sites and open spaces, for biking, camping and hiking. Recreational activities such as surfing, running, tennis, volleyball, basketball and golf also keep residents of the O.C. healthy and active. All the healthy amenities are great, but real estate in the area is a bit steep, averaging 1.5 million for homes, according to zillow.com.

9. Denver, Colorado — Residents of Denver, Colorado have access to historic western and cultural attractions (Denver Art Museum and the Denver Zoo) and natural beauty to hike, raft, horseback ride and camp. The Mile High City also has affordable rentals with $978 for a two-bedroom apartment, according to mynewplace.com.

10. Austin-San Marcos, Texas — Dubbed the “live music capitol of the world,” Austin, Texas is also one of the healthiest cities for its high ranks in physical activity. The area also has the highest number of gyms and health clubs in the U.S, along with being a biker friendly area and one that is very eco-conscious, aptly named the “Greenest City in America,” by MSN. The city also has affordable apartments with the average two-bedroom rental at $1,065, according to apartments.com.

And now for the low-ranking cities…

1. New Orleans, LA

2. San Antonio, TX

3. Cincinnati, OH-KY-IN

4. Cleveland-Lorain-Elyria, OH

5. Orlando, FL

6. Columbus, OH

7. Detroit, MI

8. New York, NY

9. Las Vegas, NV-AZ

10. Indianapolis, IN

Listing Courtesy of Sperling’s Best Places

May 10th, 2010 by

Admin

Categories:

Home Improvement,

Insurance,

Mortgages,

Moving,

Moving Industry,

Plan Your Move,

Plan Your Relocation,

Real Estate,

Relocation,

Saving Money Comments:

1 Comment »

Night View of the Brooklyn Bridge and Lower Manhattan

By Serena Norr

Often dubbed “the Greatest City in the World,” New York City is a cultural melting pot that millions of people call home. Within this prime locale, residents have access to fine dining and nightlife, ethnic cuisine, museums and galleries, Broadway shows, sporting events and recreational parks and facilities.

With all of these unique amenities, it’s no wonder people from all over the world are moving to New York every year. However, once you relocate to NYC there is the issue of finding a place to live. There is no shortage of housing options in NYC with luxury apartments, two-family houses, buildings, condos and coops, brownstones, and even some houses with property; however these places don’t come without a sizeable price tag. In fact, when you move to NYC you will quickly find that locale determines the price of real estate. Due to these high-rentals (and desire for space), many people have moved away from Manhattan, opting for a two-bedroom apartment in Brooklyn, as opposed to a studio in the Lower East Side. This real estate shift has greatly altered what neighborhoods are desirable in NYC; however the high-end Manhattan real estate shows no signs of slowly down with new development deals and luxury condos throughout the city.

From new commercial developments to residential brownstones on the market to celebrity deals, there is always something exciting happening in the NYC real estate scene. On the beat of the real estate industry are some extraordinary NYC bloggers that are on top of the latest industry news and trends and whose sites feature in-depth articles ranging from tenant’s rights to real estate taxes. Here are some of Relocation.com’s favorites:

Created by Jonathan Butler in 2004, Brownstoner covers Brooklyn’s real estate market, latest news, new housing developments and renovation projects. This also includes covering housing issues in Brooklyn, buying tips and pictures of houses, and listings of apartments, coops and condos on the market. The site has grown tremendously since it began that also includes a directory of services, a community forum, restaurant guide, links to various renovation blogs and a sister site called Brownstoner Philadelphia.

A free listing resource, How to Rent in NYC features no broker fee and no fee apartments. The site also includes a renters section where users can write reviews about their landlords, as well as place to read past tenant’s experiences. Created by Alicia Schwartz, the site also features a directory of no fee management companies and landlords, a helpful question and answer segment for renters, rental articles and a listing of moving companies to get you to NYC.

Covering all of Manhattan, NYC Blog Estate features current real estate listings, recent developments and informative articles about the industry. Users can also navigate their way through the site based on the neighborhood they are interested in. The site also has a buyer and seller section where interested parties can post their home or apartment for a direct sale.

A self-professed “real estate solider,” Property Grunt features the latest news on Manhattan’s real estate industry. The daily blog also provides commentary pertaining to current issues such as crooked real estate transactions, taxes and housing issues, problems with landlords, housing reports, tenant’s rights and pictures of local real estate developments.

A print and online edition, The Real Deal features daily content about real estate news, commercial developments, foreclosed properties and expensive deals throughout the NYC area. Stories can also be broken down by neighborhood and users can share their tips about real estate to the website’s editors. The site also has an event section and listing of offices, retail spaces and commercial properties for sale.

The New York Observer’s blog-The Real Estate covers stories about high-end real estate transactions, building developments, tenant experiences and market reports. They also showcase “it’s free to look” area where users can check out luxury apartments and condos on the market.

Published by the Heddings Property Group, the True Gotham blog delivers content that pertains to the inner workings of the real estate industry. Taking an open and honest approach, the site features market reports of transitions in Manhattan, industry news, podcasts and videos and a residential listing section.

As mentioned, in our Best Real Estate Blogs in Los Angeles post we are fans of Curbed and their network of websites. The New York addition — aptly named Curbed NY— follows a snarky and direct approach to covering the latest news and headlines of the NYC real estate market. The site also features celebrity homes on the market (Olsen twins home for $.45 million is just one example), real estate gossip and developments, commercial real estate news, real estate construction and a link to their flickr site showcasing gorgeous photos of real estate around the city. Sellers can also list their home and buyers can search through homes on the market at the Curbed Marketplace.

A comprehensive real estate site, Urban Diggs analyzes the Manhattan real estate market through the use of macro economics to determine real estate trends and investment strategies. Created by Noah Rosenblatt, the site provides in-depth articles, a user discussion section, charts of current trends and insider tips. The also site covers renovations, mortgages, inventory and features a contractor directory.

Everything is coming up green, which also rings true for the real estate industry. Green Buildings NYC not only covers the real estate segment, but design and construction projects in the greater NYC area. The content on the site is organized by neighborhood where users can discover the latest news and articles on green building and sustainability on office spaces, commercial real estate, architecture projects, environmental issues, energy efficient buildings, alternative energy sources, lawn development and much more. Through the site users can also learn about local events, engage in a community forum, locate jobs and search for green real estate listings.

So the moving company has left, all your stuff is set up perfectly and you’re looking to get some work done. Don’t hire a contractor without first asking these questions:

Are you covered?

This is a question with no wiggle room. Under so circumstances should you work with an individual or company that is not licensed and bonded. That means requesting–and verifying–proof that he or she is currently state licensed, paying employees legally and carrying workers’ compensation, property damage and liability insurance.

What clubs do you belong to?

If your prospective contractor has a list of clubs and associations they belong to, it’s always a good sign. Usually, members are encouraged to attend continuing education program courses, and they often receive professional designations such as Certified Graduate Builder (CGB).

What is the estimate?

Along with the other questions you want to ask during the process of hiring a contractor, you should request an itemized estimate from each. Be sure to look over the information thoroughly, paying particular attention to those that seem too high as well as too low. Estimates that fall in the shallow end of the pool can be a red flag for a hasty job that won’t leave you with a quality product; those on the high end might have artificially inflated prices.

Can I have a copy of the schedule?

You need to know exactly how long that kitchen renovation is going to take. Before you hire a contractor, you should ask them to provide you with a fixed start date and a completion date–including any cleanup duties. These dates should be included in the formal written agreement, along with a timetable of the work that’ll be done and a material list of everything that’ll be needed.

What is the payment schedule?

Most professional builders work on a pay-as-you-go basis, receiving partial payments throughout the process. The payments for new construction, also called draws, typically are scheduled as a certain percentage of the total cost when specific stages of construction are completed. Avoid any contractor who wants full payment before starting the job.

In addition to your references, can I have a list of previous customers?

It’s one thing to talk to a list of people the contractor has prepared for your call; it’s another thing to cold call prior customers from whom you’re more likely to get an honest assessment.

Can I see some of your projects?

Good builders are proud of their work and enjoy showing it to potential clients. Ask to see photographs of complete projects, and choose someone whose work looks similar to the job you’re planning.

How do you schedule call backs?

You want to know what to expect and how to best contact the contractor if, for any reason, they need to come back and fix or redo a job. Go with the person that has a concrete plan for these types of issues.

Related Articles:

How to Set Your Home Improvement Plan

Hiring a Contractor: When to Know When You Need One

How to Get Along With Contractors

Picture this: A college student—we’ll call him Larry—of meager means rents his first studio apartment. It is the typical young person’s starter home: cheap TV and cheaper sofa, packing box for coffee table, futon cushion for bed. Does this kid need renter’s insurance? Most people think the coverage is in place to protect the holder’s property in case of theft. Since Larry has nothing, why insure it? What is often missed is that the coverage also protects the holder’s assets in case of mishap.

Say the person living downstairs from Larry has lots of very expensive stuff. Now imagine Larry gets drunk, comes home, runs a bath and passes out. Water overflows from the bathtub and drains into the apartment below. Lots of very expensive stuff is ruined. Renter’s insurance covers the costs and saves Larry from a life of indentured servitude.

What if a pipe bursts in the apartment above Larry and not only is Larry’s stuff totaled, but he needs to find some place to crash until the landlord can fix the mess. Having insurance can mean the difference between couch surfing and staying at a nice hotel with a real bed.

What if Larry wants to impress a girl and has some friends over to help him paint the pad before the big date. Then one of his pals falls off the ladder while painting the ceiling and breaks an arm. Renter’s insurance will usually have liability protection, which means that if someone in the apartment slips and falls, the policy holder is covered for any costs, up to the liability limit. And if Larry’s friend sues him, he’s covered for what they win in a court judgment up to your policy’s limit, along with legal expenses.

So, how much does this cost? Just like any other insurance, the premium depends on a number of factors: location, deductible, insurance company and the need for additional coverage. If you shop around, you’ll probably find a policy for $150 and $300 per year, which will get you about $30,000 to $35,000 worth of coverage for your personal possessions and somewhere between $100,000 and $300,000 worth of liability protection.

Come on, admit it, even if you don’t have much, it’s still worth it to cover yourself with some renter’s insurance, ‘cause you never know, right?

Related Articles:

Life Insurance: How Much Do You Need?

Focus on Finding the Right Insurance Agent

These Big Changes in Your Life Will Affect Your Insurance Needs